Table of Content

If it's incorrect, you could be paying HMRC more money than you need to be. By the same token, you risk penalties - usually in the form of a tax bill - for paying too little. Find out as much as you can about the umbrella company’s background. Check their credit rating and how long the company has been trading. Both of these are good indicators of how much you can trust a company.

To decide between an umbrella company and limited company, carefully consider how much time and effort you can commit to contracting. If you’re just starting out or, for whatever reason, you don’t have the time to take care of invoicing and tax, an umbrella company may be the best option. At Umbrella Broker, we make it easy for contractors to find the perfect umbrella company for their needs. We have a wide collection of handpicked, well-reviewed providers, ready for you to compare online.

Tax classes in Germany:

For workers who are subject to social security contributions, "midi-jobs" have raised from €1,300 a month to €1,600. If you are an Individual entrepreneur, you will be taxed under personal income tax. This is applied to net income from professional activities and is paid on a quarterly basis. Though both options offer you a route into the world of contracting, there is a considerable difference between contracting under an umbrella or through your own limited company. Ultimately, this decision comes down to personal preference, your assignment requirements and which route best suits your unique needs. Every UK employer is required to offer and contribute to a workplace pension scheme for their employees, and as your umbrella company is your Continue reading...

Claiming expenses As a sole trader, you will pay out for various costs that are needed in order for you to ... Your Personal Allowance will reduce if you earn above £100,000, and you may have additional tax to pay of up to £96.76 per week. Ignores the effect of the Annual Employment Allowance (£5,000) on the limited company column . Online registration form must be completed by midnight 6th December 2019.

Umbrella take home pay calculator

This allows you to claim numerous extra expenses as well as drawing some of your funds out as a dividend, which is subject to far less tax than the PAYE rate. However, as business begins to grow and more opportunities arise, it may become more suitable to set up a limited company. This changes how you’re taxed and can increase your income as a result. Unfortunately, it’s easier said than done, so it’s important not to dive in too soon. Alternatively, if you’re looking for the highest possible income and you’re prepared to commit the time and effort – a limited company might be suitable. Remember, a limited company is more of a commitment, while you can easily use an umbrella company for a short period to test things out.

The alternative – setting up your own limited company – provides higher income as a trade-off for more administrative work. With that in mind, umbrella companies are the ideal solution for contractors that don’t have the time to run their own business while also completing contract work. You’ll no doubt have seen certain umbrella companies making bold claims of high take-home pay percentages and figures.

Allowances and Tax Reliefs

All of the applications on Umbrella Broker are hosted by Adobe Sign, a safe and secure way to sign your contract and pass your personal details onto the umbrella. You can even insure portable items, which aren’t stored permanently in your office. Fortunately, with the right flexible policy, you can get insurance for remote working too – so yourself or any employees will be insured when working at home. After taking the status tests, you can print your results as a way to demonstrate that you took reasonable care.

If you're already a client of ours, you can speak to your dedicated accountant directly. Appointing an accountant can save you time and stress when starting up on your own. If you would like to speak to someone about any of the above information or any other queries you may have, arrange a callback and a member of the team will be in touch. This illustration is based on holiday being rolled up and pre-paid.

How Pensions Auto-Enrolment Works for Umbrella Company Employees

It’s never been easier to choose the best umbrella company for you. The tax class affects the rate of income tax, solidarity surcharge and church tax. According to our salary calculator for Germany, that's a net salary of around €18,405, or €1,534 a month, if we run the numbers in Berlin.

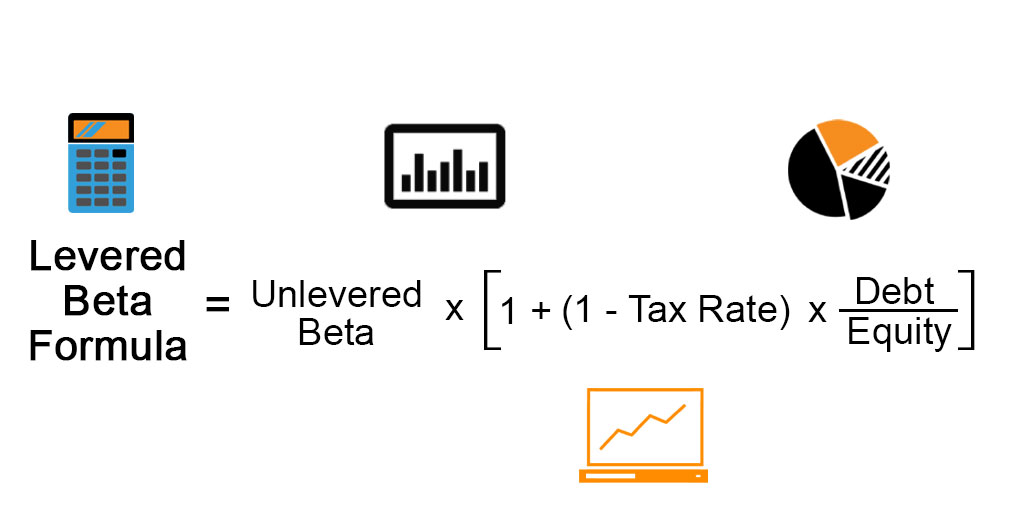

Be sure to inform any existing clients about your plans to set up as a limited company as well as any service providers or suppliers. Unlike an umbrella company, you’re solely responsible for your finances, tax and general administration. That means processing invoices, chasing payments and paying yourself through the company. It may even be worth hiring an accountant to assist with these responsibilities, which could take away some of the financial benefit. A flat corporate income tax rate is 15% plus a surtax of 5.5% applies to the resident and non-resident companies on the profits after the deduction of business expenses. You can calculate corporation tax online using the German Corporation Tax Calculator.

With that in mind, it’s important to determine whether you’re operating inside IR35 or outside of it. Unfortunately, there is no clear way to tell because IR35 has no set definition for a case which is inside or outside of the regulation. A PSL gives you a list of recommended umbrella companies to choose from to narrow things down.

Contractor calculators are also useful when considering what you might expect to earn from potential contracts. It may be useful if your umbrella company provides an online portal, making it easier to keep track of what you’ve submitted and do things when it suits you. Instead, it’s about deciding where the risk lies and which plans are required to cover you. Professional Indemnity and Public Liability are the two most common insurance types held by contractors – in addition to Employers’ Liability insurance because it’s required by law. It also includes your clients when they visit your premises, as well as any damage that may be caused by you or your employees when visiting a client’s site. Let’s say you knock over something expensive while you’re there – they won’t think twice about claiming for that damage.

No comments:

Post a Comment